A Dollar Saved

Learning to save gives Guilford County middle schoolers a head start on their futures.

Cynethia Mayhand, left, family and consumer sciences teacher at Western Guilford Middle School, with her former student Sa’Raya Fitzgerald. Fitzgerald says she has a head start on saving for college thanks to a budgeting and savings class taught by Mayhand in collaboration with Shameca Battle, family and consumer sciences agent in Guildford County.

GREENSBORO – Sa’Raya Fitzgerald is only 14, but the eighth-grader at Western Guilford Middle School has already learned strategies for success that many adults take years to learn – if they ever do.

“I learned that every decision has a consequence; some are riskier than others,” she said. “I know that wants and needs are different – a want is something you can live without, but a need is essential.”

How do you get a teenager to think and act responsibly about money, to save some of her weekly allowance rather than spend it all on fast food or overpriced athletic shoes? Fitzgerald was always the type of student who wanted to learn to budget and save money for her future, but two adults helped her find the means to develop a savings plan. One was Cynethia Mayhand, who teaches family and consumer science at Western Guilford Middle School. The other was Shameca Battle, a family and consumer sciences agent in Guilford County with Cooperative Extension at N.C. A&T.

Five years ago, Mayhand began a budgeting and savings program with her students. She contacted several financial institutions who donated piggy banks for the students, encouraged them to put at least a dollar into the bank at the beginning of the class, and rewarded every student who was able to save money during the semester with a perfect score of 100. Students who opened savings accounts at real banks received extra credit, and two students, one from each class taught by Mayhand, who saved the most received a $25 gift certificate out of her own pocket.

Mayhand was familiar with Cooperative Extension at N.C. A&T through the Expanded Food and Nutrition Education Program (EFNEP), which had been presented to students at her previous school in High Point. She learned that Extension also offered programs in budgeting and finance, and she connected with Battle. For the last two years, Mayhand and Battle have taken a team approach to financial education for middle schoolers, using the resources of Next Gen Personal Finance, a nonprofit that offers curricula to improve the financial lives of young Americans.

Through a series of interactive lessons, educational games and discussions, the students learn the importance of living within a budget, the difference between needs and wants, and the benefits of saving money – even a small amount of it – at a young age. So far, their educational strategy seems to be working.

“I learned that I need to look at the prices of things,” said Fitzgerald. “Before I was risky with my money. Now, I have a college fund with my grandfather, another one with my mother and a backup emergency fund.”

A chance at a head start

The class presents a hypothetical individual and follows him from childhood through retirement, with the students learning about the different financial decisions and challenges that come at different times in life, from saving for college to investing to taxes to the financial considerations of major events such as marriage, raising children and retiring. Fitzgerald, who was part of the class in the fall of 2019, saved $30 over the seven weeks and her class as a whole saved $318. By May 2020, her savings had grown to $445 in one bank account and $785 in another.

“I am determined about my future,” said Fitzgerald, who will attend the Early College Academy at Dudley High School in the fall. “This class taught me how I could further my future and get a head start by putting some money away.”

Mayhand said teaching personal finance and budgeting to middle school students can be challenging. They think they know how to save, but they often don’t understand the tradeoffs of the financial decisions they make or the opportunity costs. For example, someone might have enough money to buy a car, but they need to understand that a car requires an investment to keep it gassed up and to pay for maintenance, registration and insurance. Similarly, someone looking for a job needs to think about the costs of a business wardrobe and transportation, which could involve buying a car.

“You can talk about it all day, but until you let them figure it out on their own, they really don’t understand,” said Mayhand. Battle, she added, helped the students reach that level of understanding.

“Shameca came in with hands-on activities they could really relate to,” said Mayhand. “It’s always good for the kids to see a different face; they tend to listen more to somebody new. She could capture their attention. She learned their names and got to know them, and they looked forward to her visits.”

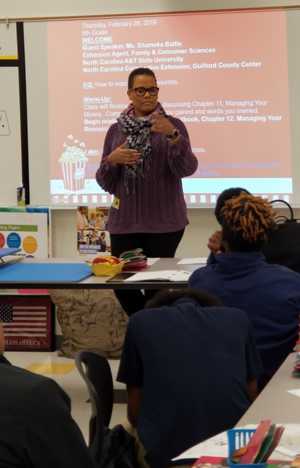

Family and Consumer Sciences Agent Shameca Battle talks to students in the budgeting and savings class at Western Guildford Middle School. Battle and teacher Cynethia Mayhand use a team approach that involves interactivity, educational games, and discussions to teach middle schoolers how to manage their finances.

From one dollar to a million

What captured Fitzgerald’s attention was the idea of compound interest – that a dollar saved today could grow to be a million dollars if given enough time.

“Before the class I felt like I should start saving early.” she said. “Ms. Battle made us realize that financial planning and savings eliminates poverty and encourages education. I can go to college without going bankrupt. I will need loans, but I can plan for that.”

One of the lessons Fitzgerald remembered most was the impact of purchasing decisions. Teenagers like to buy name brand shoes and clothes, sometimes because they want to impress their friends. However, are recognized, name brand shoes worth the cost if you can buy two pairs of a lesser known brand for half the cost? These are the kinds of questions that get kids talking and thinking about their own finances and what they really want out of life, according to Mayhand.

When students can safely return to their classrooms after the COVID-19 pandemic, Mayhand plans to once again give her students piggy banks and see how much money they can save. The record for savings by one class currently stands at $890, and one of the motivations for her students is to try to beat that record. Battle will also be on hand to team teach and lead hands-on activities.

“It is rewarding to see the kids get excited about saving and realize they can take charge of their finances and even grow their money,” said Battle. “Financial literacy and the ability to save can make such a difference for these kids. Even if they come from a low-income family, they have a tool they can use to make their future better.”

As for Fitzgerald, she knows she wants a full life and a good education. Right now, she is thinking about a career in either medicine or law, but realizes her interests and goals might change. She also knows there will be a price tag involved with reaching her goals, but feels confident she will have the money she needs, when she needs it.

“I’m glad I am thinking about this early,” she said. “I would like to be that person who turns one dollar into a million.”